electionmo.ru

Tools

How To Purchase Stock For Beginners

This guide will cover everything you need to know to start investing in the stock market. Before diving in, it's important to remember when you invest, your. Start small: You don't need a lot of money to buy stocks. Most brokerages allow you to purchase fractional shares, which just means less than one share. For. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. Tap the Investing tab on your Cash App home screen · Tap the search bar and enter a company name or ticker symbol · Select the company whose stock you want to buy. The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You can open a brokerage account for. There's a lot to accomplish in the stock market; you can buy stocks and hold them for a long time while collecting dividends. Stocks can also be traded. You can. Usually you need to open an account with a broker to buy and sell stocks online. Some publicly traded companies, however, do offer a direct stock purchase plan. This article serves as a guide, walking you through the steps of purchasing shares, differentiating between trading and investing, unveiling the best. What Is the Easiest Way to Buy Stock? The easiest way, in terms of getting a trade done, is to open and fund an online account and place a market order. While. This guide will cover everything you need to know to start investing in the stock market. Before diving in, it's important to remember when you invest, your. Start small: You don't need a lot of money to buy stocks. Most brokerages allow you to purchase fractional shares, which just means less than one share. For. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. Tap the Investing tab on your Cash App home screen · Tap the search bar and enter a company name or ticker symbol · Select the company whose stock you want to buy. The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You can open a brokerage account for. There's a lot to accomplish in the stock market; you can buy stocks and hold them for a long time while collecting dividends. Stocks can also be traded. You can. Usually you need to open an account with a broker to buy and sell stocks online. Some publicly traded companies, however, do offer a direct stock purchase plan. This article serves as a guide, walking you through the steps of purchasing shares, differentiating between trading and investing, unveiling the best. What Is the Easiest Way to Buy Stock? The easiest way, in terms of getting a trade done, is to open and fund an online account and place a market order. While.

However, you can take part in self-directed trading by using a broker-dealer platform. Stock trading without the typical broker can help you avoid hefty. Here are five steps on how to buy shares as a beginner: #1. Select an Online Stockbroker When it comes to buying shares, you have three main options. In this investing guide, parents and their teens will learn all about investing for beginners (including the upsides of investing young). You buy and sell shares through a stock broker To buy and sell shares on the stock exchange (called 'trading') you'll need to place an order through a stock. Nothing in the Stock Market Is Guaranteed · Know You're Betting on Yourself · Know Your Goals, Timeframe and Risk Tolerance · Research, Research, Research · Keep. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. This section explains why you should consider investing in the stock market, and gives you an overview of two common investment goals. The first step of how to start investing in the stock market is easy enough. Before you buy your first stock, you have to have an account to hold it. The process of stock trading for beginners · 1. Open a demat account · 2. Understand stock quotes · 3. Bids and asks · 4. Fundamental and technical knowledge of. Beginners, Futures Trading, IRA Accounts, Options Trading, Penny Stock Trading, High net Worth Investors, and Ease of Use. E*TRADE's star ratings for all. Stock Investing For Beginners: How To Buy Your First Stock And Grow Your Money [Roberts, John] on electionmo.ru *FREE* shipping on qualifying offers. This step-by-step guide is designed to help you make well-informed decisions and invest in the stock market with confidence – from the get-go. Beginners, Futures Trading, IRA Accounts, Options Trading, Penny Stock Trading, High net Worth Investors, and Ease of Use. E*TRADE's star ratings for all. Step-by-step guide to buying a stock · 1. Open your brokerage account · 2. Dig into your stock · 3. Buy your stock. Momentum investing. Momentum investors ride the waves of market trends. For example, if the market is rising, momentum investors will buy stock, and if the. To start investing in stocks, you would find a company that you like and think might grow in value and then purchase its stock through a brokerage account. How to buy a stock · Go to the stock's detail page to view the stock's historical performance, analyst ratings, company earnings, and other helpful information. What are stocks? A stock (also called an equity or share), is an investment that lets you own part of a public corporation and may allow you to vote on key. Open an account to buy shares ✓ Research the shares you want to buy ✓ Execute trades in your account ✓ Optimize your stock portfolio. The best time of day to buy stocks is usually in the morning, shortly after the market opens. Mondays and Fridays tend to be good days to trade stocks.

Current 30 Yr Mortgage

Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Get current 30 year mortgage rates and offers from loanDepot. We are a direct lender offering low 30 yr fixed rate home loans. See today's refi and purchase. Year Fixed Rate · Interest% · APR%. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate 30 year Fixed rate mortgage with an interest rate of %. Browse today's current mortgage interest rates for purchase ; XXX · 30 year FHA · XXX · XXX · 7/6 month ARM. year mortgage rates currently average % for purchase loans and % for refinance loans. · Mortgage Purchase rates in Charlotte, NC · Current year. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. year fixed. %. year fixed. %. FHA year fixed. %. VA year fixed. %. Rates current as of 8/29/, PM. Rates are provided. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Get current 30 year mortgage rates and offers from loanDepot. We are a direct lender offering low 30 yr fixed rate home loans. See today's refi and purchase. Year Fixed Rate · Interest% · APR%. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate 30 year Fixed rate mortgage with an interest rate of %. Browse today's current mortgage interest rates for purchase ; XXX · 30 year FHA · XXX · XXX · 7/6 month ARM. year mortgage rates currently average % for purchase loans and % for refinance loans. · Mortgage Purchase rates in Charlotte, NC · Current year. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. year fixed. %. year fixed. %. FHA year fixed. %. VA year fixed. %. Rates current as of 8/29/, PM. Rates are provided. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %.

In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. Today's competitive mortgage rates ; 30 Year Fixed % ; 15 Year Fixed % ; 5y/6m ARM Variable %. A loan used for purchasing or refinancing a home with an interest rate that never changes and a repayment term of thirty years. Mortgage Rates ; VA Loans · % · % · 0% · to year ; Military Choice · % · % · 0% · to year ; Conventional Fixed Rate · % · % · 5%. For today, Tuesday, September 03, , the current average year fixed mortgage interest rate is %, down 7 basis points compared to this time last week. Compare today's year mortgage rates ; year fixed FHA ; year fixed FHA, %, %. The average rate on a year fixed mortgage remained relatively stable at % as of August 29, marking its lowest level since mid-May , according to. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday. Introduction to Year Fixed Mortgages ; 30 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. Current mortgage and refinance rates ; % · % · % · % ; % · % · % · %. Mortgage Rates. Current Mortgage Rates. 30 Year Fixed Rate. % Rate Data. Today's Mortgage Rates · Compare Rates from Local Lenders · MND's Daily Rate. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 3 basis points from % to % on Sunday. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Year FixedYear FixedAdjustable-Rate MortgageBorrowSmart AccessFHA The best way to get your current mortgage rate is to let us estimate it based on your. A year fixed-rate mortgage is the most common mortgage loan option. It has a repayment period of 30 years and the interest rate doesn't change throughout the. 30 Year Fixed** · $ · % ; 15 Year Fixed** · $ · % ; 5yr/6mo ARM** · $ · % ; Home Construction Loan** · $ · % ; FHA Loan · $ · %. Year Fixed Rate ; Rate: % ; APR: % ; Points.5 ; Estimated Monthly Payment: $1, Rates shown reflect current products available with Rocket Mortgage, a provider on our network. year Fixed-Rate Loan: An interest rate of % ( For example, the monthly principal and interest payment (not including taxes and insurance premiums) on a $,, year fixed mortgage at 6% interest is. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %.

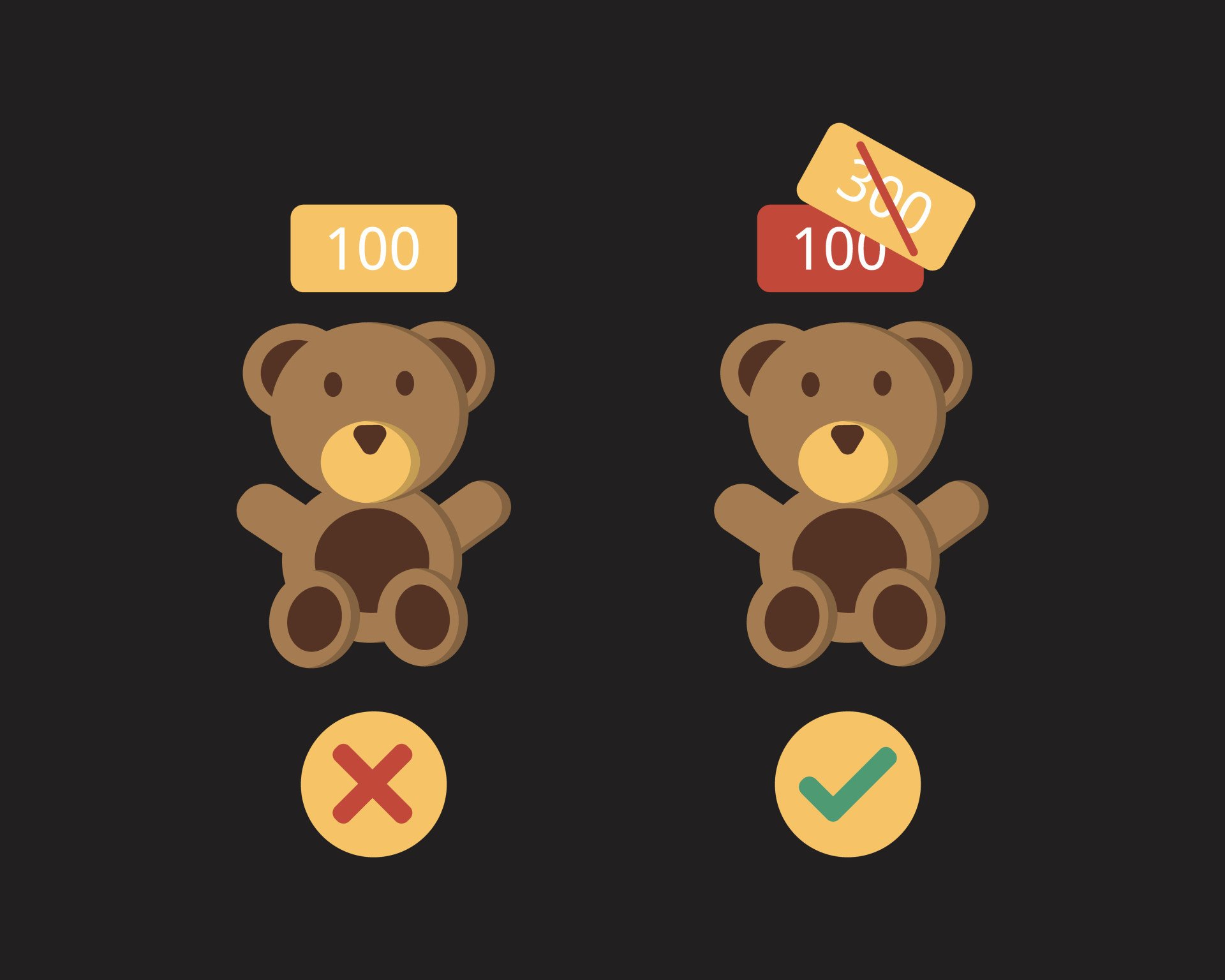

What Is Anchoring Bias

Anchoring bias is a cognitive bias that occurs when a trader relies too heavily on a single piece of information or past experience when making decisions. The anchoring bias is a pervasive cognitive bias that causes us to rely too heavily on information that we received early in the decision-making process. The anchoring effect is a cognitive bias that describes the common human tendency to rely too heavily on the first piece of information offered. Anchoring bias is a cognitive bias that causes us to rely too heavily on the first piece of information we are given about a topic (the "anchor") when. Anchoring bias occurs when people rely too much on pre-existing information or the first information they find when making decisions. In investing, anchoring bias can lead investors to overlook opposing views or trust incorrect information. That ultimately leads to bad decisions, such as. Anchoring bias is the tendency to rely too heavily on the first piece of information encountered (the “anchor”) when making subsequent judgments or decisions. Unlike the conservatism bias, which has similar effects but is based on how investors relate new information to old information, anchoring occurs when an. What is the anchoring bias? An anchoring bias is our tendency to rely too heavily on the first piece of information. That then serves as a reference point and. Anchoring bias is a cognitive bias that occurs when a trader relies too heavily on a single piece of information or past experience when making decisions. The anchoring bias is a pervasive cognitive bias that causes us to rely too heavily on information that we received early in the decision-making process. The anchoring effect is a cognitive bias that describes the common human tendency to rely too heavily on the first piece of information offered. Anchoring bias is a cognitive bias that causes us to rely too heavily on the first piece of information we are given about a topic (the "anchor") when. Anchoring bias occurs when people rely too much on pre-existing information or the first information they find when making decisions. In investing, anchoring bias can lead investors to overlook opposing views or trust incorrect information. That ultimately leads to bad decisions, such as. Anchoring bias is the tendency to rely too heavily on the first piece of information encountered (the “anchor”) when making subsequent judgments or decisions. Unlike the conservatism bias, which has similar effects but is based on how investors relate new information to old information, anchoring occurs when an. What is the anchoring bias? An anchoring bias is our tendency to rely too heavily on the first piece of information. That then serves as a reference point and.

Anchoring bias refers to the tendency for people to rely heavily on the first piece of information they receive when making decisions. Although anchoring bias and availability bias are both types of cognitive bias (or heuristics) and may seem similar, they are quite different. The anchoring effect is a psychological phenomenon in which an individual's judgments or decisions are influenced by a reference point or "anchor" which can be. The anchoring effect is a cognitive bias that describes the common human tendency to rely too heavily on the first piece of information offered. Anchoring bias occurs when people rely too much on pre-existing information or the first information they find when making decisions. Anchoring bias is the tendency to rely too heavily on the first piece of information encountered (the “anchor”) when making subsequent judgments or decisions. So anchoring bias occurs when individuals use the initially provided information to make subsequent judgments; the first piece of information offered (the. Anchoring or focalism is a term used in psychology to describe the common human tendency to rely too heavily, or "anchor," on one trait or piece of. What is Anchoring Bias? Definition of Anchoring Bias: Focusing mainly on the first piece of information or anchor and considering it as a baseline while. An *unconscious bias in which we rely too heavily on one trait or detail in decision-making. Access to the. Anchoring is a behavioral finance term to describe an irrational bias towards an arbitrary benchmark figure. This benchmark then skews decision-making regarding. Examples of anchoring in price perception · Example 1: Putting overpriced items on the menu first · Example 2: Changing the context to make the price seem lower. During decision making, anchoring occurs when individuals use an initial piece of information to make subsequent judgments. Once an anchor is set, other. Anchoring bias, also called the anchoring effect, is people's tendency to use the first piece of information that they receive on a subject as an anchor. Anchoring bias is a heuristic or mental shortcut that relies on the first information you receive concerning a subject. Anchoring is a cognitive bias that occurs if someone presents information in a way that limits an audience's range of thought/reference. Thus the “anchoring bias” is often a part of a negotiating strategy. By dropping a strategic “anchor,” negotiators are able to frame the negotiation to. Anchoring bias is a type of cognitive bias that refers to the tendency of people to rely too heavily on the first piece of information they receive when making. We've all heard of cases where two people receive very different sentences for committing identical crimes. One hidden bias that can influence these kinds. When humans are exposed to a variety of information, Anchoring Bias or anchoring influences the way they process the information and come to a conclusion. For.

What Is A Refinancing

:max_bytes(150000):strip_icc()/Investopedia-terms-cash_out-refinance-7a7a8b788e544e22ab9f72a09a99cd81.jpg)

Refinancing happens when you pay off your current mortgage with money from a new mortgage. Often homeowners refinance to try to lower the cost of their mortgage. Cash-out refinance gives you a lump sum when you close your refinance loan. The loan proceeds are first used to pay off your existing mortgage(s), including. Refinancing is the replacement of an existing debt obligation with another debt obligation under a different term and interest rate. This page explores the most common questions which arise when homeowners consider refinancing their mortgage. Mortgage refinancing replaces your current mortgage with a new loan. Depending on your financial needs, you might take out a new mortgage or just enough to pay. If your home has increased in value or if you have paid enough into your home so that you owe less than 80% of what it's worth, you can refinance into a new. Refinancing your mortgage basically means that you are trading in your old mortgage for a new one, and possibly save money in the process. By refinancing your current loan at a lower interest rate, you may be able to realize interest savings over the lifetime of the loan. Consult with a PNC. Refinancing (refi) is a financial strategy that involves replacing an existing loan with a new one, typically with more favorable terms. Refinancing happens when you pay off your current mortgage with money from a new mortgage. Often homeowners refinance to try to lower the cost of their mortgage. Cash-out refinance gives you a lump sum when you close your refinance loan. The loan proceeds are first used to pay off your existing mortgage(s), including. Refinancing is the replacement of an existing debt obligation with another debt obligation under a different term and interest rate. This page explores the most common questions which arise when homeowners consider refinancing their mortgage. Mortgage refinancing replaces your current mortgage with a new loan. Depending on your financial needs, you might take out a new mortgage or just enough to pay. If your home has increased in value or if you have paid enough into your home so that you owe less than 80% of what it's worth, you can refinance into a new. Refinancing your mortgage basically means that you are trading in your old mortgage for a new one, and possibly save money in the process. By refinancing your current loan at a lower interest rate, you may be able to realize interest savings over the lifetime of the loan. Consult with a PNC. Refinancing (refi) is a financial strategy that involves replacing an existing loan with a new one, typically with more favorable terms.

Mortgage refinancing is when a homeowner pays off their existing home loan with a new one that typically saves them money through a lower interest rate. There are two primary options you'll need to choose between: no cash-out refinance and cash-out refinance. Each is designed to meet specific goals. Refinancing can be a wise decision, and can allow you to lower your monthly payments, or get a shorter loan term. The Refinancing Process Explained Once you decide that refinancing is the right choice for you, submit an application and any necessary documents. We'll. Refinancing is simply taking out a new loan at a different interest rate and using it to pay off your existing loan. A simplified online application makes it easier to apply for a mortgage refinance with Wells Fargo. Use our refinance calculator to find your rate. A home equity line of credit is a revolving loan that allows you to borrow money, pay it back and re-borrow up to your maximum limit. While a mortgage refinance. Refinancing your mortgage can be a great way to lower your interest rate and reduce your monthly mortgage payment, but it can also impact your credit scores. Whether you're looking to reduce your monthly mortgage payments or buy another home, refinancing with Pine can save you thousands. Mortgage refinancing replaces an existing loan with new terms, offering benefits like lower rates and debt consolidation. Refinancing can provide relief from the burdens of loans, offering a spectrum of possibilities tailored to individual needs. Whether it's obtaining lower. Learn more about your mortgage refinancing options, view today's rates and use our refinance calculator to help find the right loan for you. Refinancing lets you take advantage of the low interest rates on your mortgage. You can access additional funds by simply adding them to your mortgage. The. Refinancing involves taking out a new loan to pay off the remaining balance of an existing loan. Ideally, the refinanced loan will benefit the borrower in some. 3% equity option. If you already have a Fannie Mae-owned loan, you can refinance with as little as 3% equity. If your mortgage isn't owned by Fannie Mae, you. Refinancing a house means you replace the mortgage you have with a new mortgage that has more favorable terms. Whether or not you should refinance depends on. Your household income has gone up. If you have a new, higher, and steady source of income, refinancing could allow you to apply more of your income toward your. To apply for refinancing, you will need to do some of the same things you did when you got the mortgage to buy your home. This includes proving your identity. Most experts recommend refinancing a mortgage if you can lower your current interest rate by at least to 1 percent. Also, it's a good idea not to plan to. Cash-out involves refinancing at a higher loan amount than your current principal balance, and obtaining the cash difference without selling the asset. A cash-.

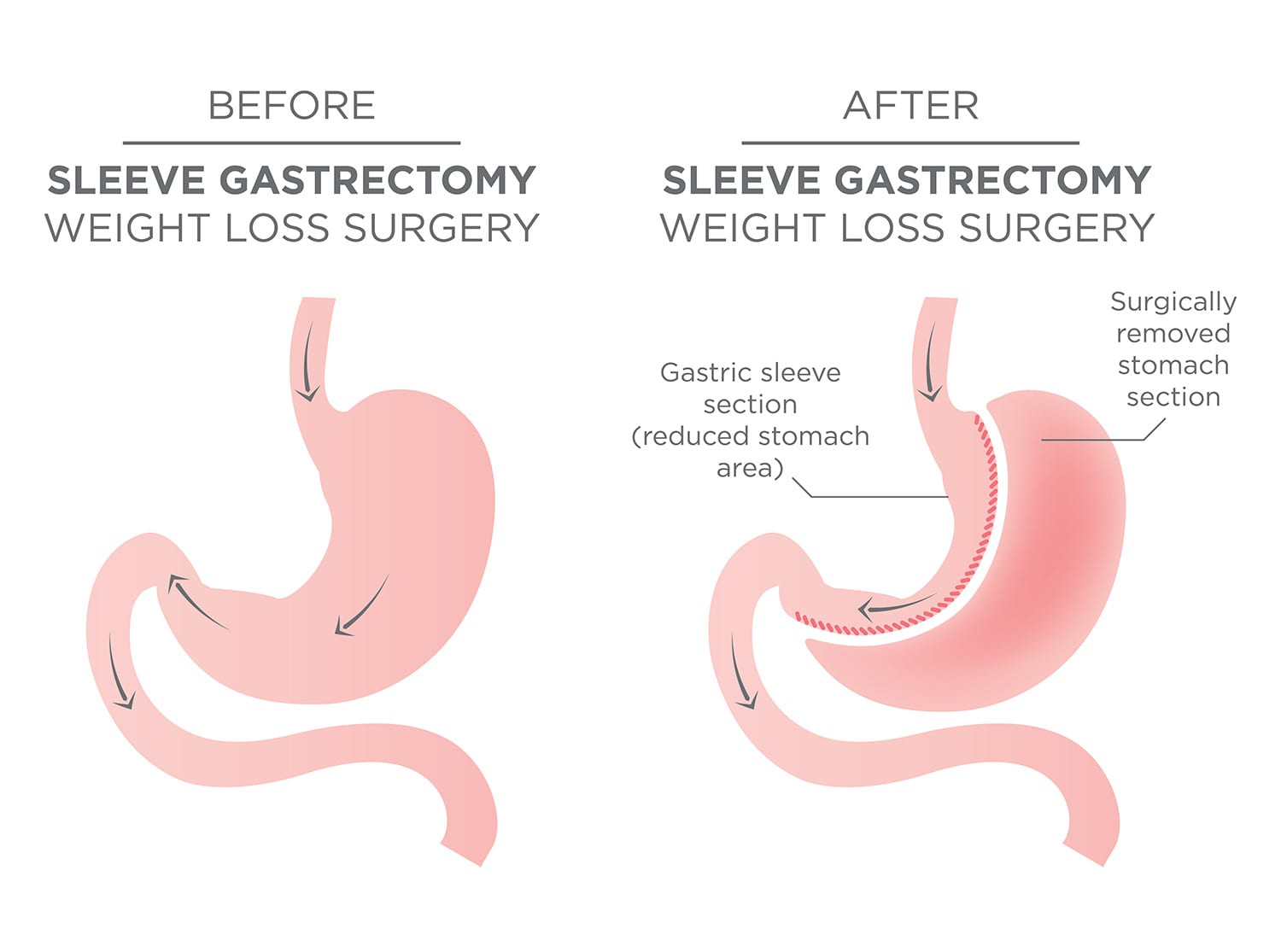

How Much Is Stomach Sleeve Surgery

What's the average cost of bariatric surgery? Weight-loss surgery costs typically range from $7, to $33, before insurance coverage. Your total expense. Weight Loss Surgery Cost · Average surgeon cost for Lap Band Surgery is $9, (Range: $1, – $18,) · Average surgeon cost for Sleeve Gastrectomy is. United States: Gastric sleeve surgery in the US typically ranges from $9, to $27,, with an average cost of around $16, United Kingdom: In the UK, the. The average cost of bariatric surgery ranges between $17, and $26, Because of the reduction or elimination of obesity-related conditions and associated. The average cost of gastric sleeve surgery without insurance ranges from $ to $, with an average cost of $ Learn more. Types of Surgery We Offer · Gastric sleeve · Gastric bypass (traditional or laparoscopic) · Laparoscopic sleeve gastrectomy · Laparoscopic adjustable gastric. The stomach is reduced in size to prevent overeating by feeling full faster. This surgery is also called gastric sleeve resection, sleeve gastrectomy, vertical. This is the most common bariatric surgery. It's also called sleeve gastrectomy. The surgeon removes about 80 percent of your stomach, leaving a pouch about the. According to nationwide averages, a gastric bypass procedure costs around $23,, while a gastric sleeve procedure costs around $15, These costs include. What's the average cost of bariatric surgery? Weight-loss surgery costs typically range from $7, to $33, before insurance coverage. Your total expense. Weight Loss Surgery Cost · Average surgeon cost for Lap Band Surgery is $9, (Range: $1, – $18,) · Average surgeon cost for Sleeve Gastrectomy is. United States: Gastric sleeve surgery in the US typically ranges from $9, to $27,, with an average cost of around $16, United Kingdom: In the UK, the. The average cost of bariatric surgery ranges between $17, and $26, Because of the reduction or elimination of obesity-related conditions and associated. The average cost of gastric sleeve surgery without insurance ranges from $ to $, with an average cost of $ Learn more. Types of Surgery We Offer · Gastric sleeve · Gastric bypass (traditional or laparoscopic) · Laparoscopic sleeve gastrectomy · Laparoscopic adjustable gastric. The stomach is reduced in size to prevent overeating by feeling full faster. This surgery is also called gastric sleeve resection, sleeve gastrectomy, vertical. This is the most common bariatric surgery. It's also called sleeve gastrectomy. The surgeon removes about 80 percent of your stomach, leaving a pouch about the. According to nationwide averages, a gastric bypass procedure costs around $23,, while a gastric sleeve procedure costs around $15, These costs include.

We perform the sleeve gastrectomy as a laparoscopic procedure. This involves making five or six small incisions in the abdomen and performing the procedure. For a limited time, The University of Kansas Health System is offering the best, lowest price for weight loss surgery in Kansas City. Gastric sleeve. In gastric sleeve surgery, also called vertical sleeve gastrectomy, a surgeon removes most of your stomach, leaving only a banana-shaped section. The purpose of gastric sleeve surgery is to reduce stomach capacity so patients consume smaller portions, thereby losing weight. Despite the substantial. A cost starting at $16, is probably realistic. Medicare, Medicaid, and some insurance providers may cover a portion of the weight loss surgery cost. If you. Bariatric surgery can cost between $15, and $23, Most people who have a bariatric procedure can because bariatric surgery is a covered benefit under. As time goes on, your weight loss will slow down. You will have regular doctor visits to check how you are doing. Emotions. It's common to have many emotions. Sleeve gastrectomy is a surgical weight-loss procedure that involves removing about 80% of the stomach, leaving a tube-shaped stomach about the size and shape. The average cost of bariatric surgery ranges between $17, and $26, Because of the reduction or elimination of obesity-related conditions and associated. How much does gastric sleeve surgery cost? · National Average: $16, · National Range: $9, – $26,+ · Outpatient Facility Average: $14, · Inpatient. Vertical Sleeve Gastrectomy: $9,; Laparoscopic Gastric Banding: $9,; Roux En Y Gastric Bypass: $14,; Endoscopic Orbera Gastric Balloon: $5, We want. The average estimated cost of gastric sleeve surgery or sleeve gastrectomy in the US between $ and $ Most major insurance companies cover. Gastric sleeve surgery is used to treat severe obesity. It's advised for people who have tried other weight-loss methods without long-term success. Your. Like other surgical procedures, sleeve gastrectomy is non-reversible. The rate of early surgical complications is comparable to a minimally invasive gastric. , Bariatric Surgery – Gastric Sleeve, $4, ; , Bariatric Surgery – Duodenal Switch, $8, ; , Bariatric Surgery – Gastric Bypass Revision. Types of Surgery We Offer · Gastric sleeve · Gastric bypass (traditional or laparoscopic) · Laparoscopic sleeve gastrectomy · Laparoscopic adjustable gastric. VIPSurg is dedicated to making bariatric surgery accessible. For those who wish to pay cash for their procedure, we have very attractive pricing! $26, Gastric Sleeve to Gastric Bypass Self Pay Pricing. We have special self-pay pricing for Gastric Sleeve to Gastric Bypass procedure that is available for. This is the most common bariatric surgery. It's also called sleeve gastrectomy. The surgeon removes about 80 percent of your stomach, leaving a pouch about the. Gastric Bypass Surgery Cost. To answer that question, the cost of gastric bypass surgery generally starts at $15, when paying out-of-pocket. For those opting.

Best Family Budget Software

MoneyPatrol is widely regarded as the best free family budget software, offering families a comprehensive and user-friendly solution to effectively manage their. One of the best online money management apps out there, Empower is a free tool that allows you to create a budget, track your spending, and save. Connect all of. YNAB is far and away the best budgeting app. In it, you can create unlimited budgets (each with different bank accounts/cards). And each of you. YNAB is possibly one of the world's most popular budgeting apps - and it focuses on your total spending and income that has accrued in the past as well as. Say hello to your new financial companion, Buddy. The joyful budgeting app. YNAB is ideal for people who have debts to pay off or savings goals they want to reach. It helps you spend smarter with tools like budget creation, goal. Best App for Couples: Honeydue After you download the Honeydue app, you can invite your partner via email or text message to download it, too. Once you both. MoneyPatrol stands out as the best family budget software, providing households with the necessary tools for streamlined financial management. With its. How it works: YNAB, which stands for “you need a budget,” is a no-frills app that employs the zero-based budget system. You map out your expenses in detail. MoneyPatrol is widely regarded as the best free family budget software, offering families a comprehensive and user-friendly solution to effectively manage their. One of the best online money management apps out there, Empower is a free tool that allows you to create a budget, track your spending, and save. Connect all of. YNAB is far and away the best budgeting app. In it, you can create unlimited budgets (each with different bank accounts/cards). And each of you. YNAB is possibly one of the world's most popular budgeting apps - and it focuses on your total spending and income that has accrued in the past as well as. Say hello to your new financial companion, Buddy. The joyful budgeting app. YNAB is ideal for people who have debts to pay off or savings goals they want to reach. It helps you spend smarter with tools like budget creation, goal. Best App for Couples: Honeydue After you download the Honeydue app, you can invite your partner via email or text message to download it, too. Once you both. MoneyPatrol stands out as the best family budget software, providing households with the necessary tools for streamlined financial management. With its. How it works: YNAB, which stands for “you need a budget,” is a no-frills app that employs the zero-based budget system. You map out your expenses in detail.

Goodbudget is a budget tracker for the modern age. Say no more to carrying paper. Buckets lets you do a form of envelope budgeting, or your own style if you'd rather. Online money management software for tracking expenses, budgets, bill reminders, investments, forecasting, financial planning & more. Another great app to help you budget is Personal Capital. It comes with free budgeting software and also includes tools to help you track your spending, wealth. Best Budget Apps for Couples in · 1. EveryDollar: Best for Dave Ramsey Followers · 2. You Need a Budget: Best for an Ad-Free Experience · 3. Goodbudget. Sharing expenses apps. Money is one of the top reasons for disagreements between people who share their spending. Let's see what apps help couples and friends. The 11 Best Free & Paid Budget Apps ; Monarch, $/month, $/year, Organization ; Rocket Money, $0-$12/month, The best budgeting app ; Empower, $0, Build. Pen and paper. Expenses OK. Envelopes. Goodbudget. Spreadsheets. Worksheets. Banking tools and apps. MoLO. SoFi Relay. Manage money in Excel. Control your household budget with Excel budget templates. Track monthly budgets by income and expenses to set financial goals. 5 Best Family Budget Apps in · 1. PocketGuard · 2. YNAB (You Need A Budget) · 3. HomeBudget with Sync · 4. Spendless - Expense Tracker Budget & Money Manager. Best overall free app: Honeydue · Best for the envelope budgeting system: Goodbudget · Best for zero-based budgeting: You Need A Budget (YNAB). Money Manager Expense & Budget ” is an optimized application for personal account management. Household account management is complicated. But we make it s. We've spent hundreds of hours determining the best apps, tools, credit cards, insurance, and more for you to get the most out of your money. TimelyBills makes saving a breeze with goal tracking. Involve your family, set goals for dream vacations or a new car, and watch your savings grow! Buckets lets you do a form of envelope budgeting, or your own style if you'd rather. The 13 Top Budgeting Apps for Couples · Empower (formerly Personal Capital) is for the couple who is serious about their future together — particularly their. I have been using Quicken for years and it's great for budgeting for all levels, from beginner to experienced user. It's very flexible in allowing the user to. The best money tracker appNavigate your finances with confidence. Track spending, budgets, investments, net worth. Now available for Mac and iPhone. Download. We reviewed the best personal finance software options from top companies including Quicken, YNAB, and more. This list will help you find which software is. Our monthly budget & spending tracker was never easier. We like to make money management, budget tracking easier. One of the easiest money management tools.

Easiest State To Form An Llc

This is the quickest and easiest filing method. The filer may simply LLC (CD ) form from the Georgia Secretary of State website. Download and. Here is everything you need to know about how to set up your small business as an LLC in the state of Oregon. Read on to learn all about LLCs! Kentucky is the cheapest state to form an LLC, with a filing fee of just $ The state also offers business owners incentive programs that provide small. State law has certain requirements for naming limited liability companies. The name of an LLC must: Be in English or any other language expressed in English. The best state to get an LLC registered is always your home state (makes things a lot simpler). But if you can't, I'd say Delaware should be the next pick. South Dakota is one of the most popular states for LLC formation because it does not charge any state income tax, has an affordable filing fee, and operates. Delaware's corporation and LLC laws are considered the most flexible in the country. The Court of Chancery has expertise in business law and uses judges instead. Swyft Filings offers several straightforward LLC filing packages, including a free package—you'll only have to pay your state's filing fees. Additionally, Swyft. Key Takeaways. Delaware, Wyoming, Nevada, New Mexico, Arizona, Florida, and Kentucky are the best states to form an LLC for your online. This is the quickest and easiest filing method. The filer may simply LLC (CD ) form from the Georgia Secretary of State website. Download and. Here is everything you need to know about how to set up your small business as an LLC in the state of Oregon. Read on to learn all about LLCs! Kentucky is the cheapest state to form an LLC, with a filing fee of just $ The state also offers business owners incentive programs that provide small. State law has certain requirements for naming limited liability companies. The name of an LLC must: Be in English or any other language expressed in English. The best state to get an LLC registered is always your home state (makes things a lot simpler). But if you can't, I'd say Delaware should be the next pick. South Dakota is one of the most popular states for LLC formation because it does not charge any state income tax, has an affordable filing fee, and operates. Delaware's corporation and LLC laws are considered the most flexible in the country. The Court of Chancery has expertise in business law and uses judges instead. Swyft Filings offers several straightforward LLC filing packages, including a free package—you'll only have to pay your state's filing fees. Additionally, Swyft. Key Takeaways. Delaware, Wyoming, Nevada, New Mexico, Arizona, Florida, and Kentucky are the best states to form an LLC for your online.

The process of transferring an LLC to another state is known as domestication. This may be the easiest and best way to handle an LLC move. You can form your LLC in your own state or in another state. (For additional information on which state to choose, read about where to form your LLC.) To. A limited liability company ("LLC") is a new form of LLCs are "organized" by filing with the state a Certificate of Organization setting forth (U.C.A. If you are starting a new business that you intend to operate within the state, you need to form a domestic LLC. The fastest and easiest way to do this is. Forming an LLC in your home state is the most advantageous option for most businesses, while business-friendly states like Delaware, Nevada, and Wyoming offer. Delaware is the best state to form an LLC if your business is expanding quickly and you want to convert your LLC to an S-corporation in the future. LP/LLC/GP Although Limited Partnerships, Limited Liability Companies and General Partnerships formed in the State of Delaware do not file an annual report, they. The easiest way to change the state of formation when moving an LLC or corporation is through a statutory transaction. Delaware doesn't tax out-of-state income, while Nevada and Wyoming don't tax any business income. So it's tempting to register an LLC in one of those states. The forms may be used to file new entities or to request changes to existing entities. The Bureau highly encourages online filing as the easiest and fastest way. For the majority of small businesses, incorporating or forming an LLC in your home state is usually the easiest and least expensive option. A domestic LLC is an LLC that operates within the state in which it was initially created. This is, by far, the most common form of LLC, and is generally the. LLCs can be formed in all 50 states, regardless of where you live or plan on conducting your business. Hi there! We are working hard to create LLC formation. Formation Process. Wyoming has a reputation for being one of the easiest states to form an LLC in. The state requires minimal paperwork and does not require an. The easiest way to register an LLC If so, you will be asked to translate the word(s) into English. Register Your LLC with New York State: Limited Liability. Between all the incorporation-friendly states my recommendation is Wyoming. Wyoming is known as one of the three incorporation-friendly states, the other two. A: When an LLC is formed, most states require that ownership information be disclosed. An Anonymous LLC is just like a “regular” LLC but does not require. Follow this step-by-step guide on forming an Iowa LLC through Fast Track Filing. You can choose to register/form your LLC in any U.S. state, regardless of your location. Several states could be a better choice when forming an LLC out of. It's of the easiest entity types to set up and maintain with few annual Form an LLC Today Only $99 + State Fees. Protect your personal assets with.

How Long Does A Sr22 Stay On Your Insurance

Contact your state's department of motor vehicles to find out the exact length of time you'll need to carry an SR — in most states, it's three years. How do. When DMV receives the SR, the policy holder's driver's license is suspended until a new SR is filed. What happens if you're involved in an accident in. If your license was suspended for Mandatory Insurance or False Insurance, you're required to keep your SR22 certificate for three years. Depending on the exact. How long do drivers need to carry SR Insurance in Texas? The excellent news about an SR in Texas is that you typically do not have to carry it forever. If you already have car insurance but need to add an SR, simply call your insurance company and request they file the paperwork for you. Most states require. How long do drivers need to carry SR Insurance in Texas? The excellent news about an SR in Texas is that you typically do not have to carry it forever. As long as you remain insured and keep your record clean, you'll be paying standard car insurance rates in a few short years. 3. The Fee for SR22 Insurance. The. An SR is a certificate which shows that you have liability insurance. An SR is proof of future responsibility and is posted to your driving record. The good news is that you do not need to pay the filing fee each year when your policy renews. As long as you stay with the same insurer and keep your. Contact your state's department of motor vehicles to find out the exact length of time you'll need to carry an SR — in most states, it's three years. How do. When DMV receives the SR, the policy holder's driver's license is suspended until a new SR is filed. What happens if you're involved in an accident in. If your license was suspended for Mandatory Insurance or False Insurance, you're required to keep your SR22 certificate for three years. Depending on the exact. How long do drivers need to carry SR Insurance in Texas? The excellent news about an SR in Texas is that you typically do not have to carry it forever. If you already have car insurance but need to add an SR, simply call your insurance company and request they file the paperwork for you. Most states require. How long do drivers need to carry SR Insurance in Texas? The excellent news about an SR in Texas is that you typically do not have to carry it forever. As long as you remain insured and keep your record clean, you'll be paying standard car insurance rates in a few short years. 3. The Fee for SR22 Insurance. The. An SR is a certificate which shows that you have liability insurance. An SR is proof of future responsibility and is posted to your driving record. The good news is that you do not need to pay the filing fee each year when your policy renews. As long as you stay with the same insurer and keep your.

If you do not, your California DMV record will reflect a lapse in coverage which could result in a new California license suspension. 6. How long must I. Failure to do so will result in a driver's license suspension. What is an SR? An SR is a certificate of insurance filed by the home office of your. Coverage Length:Most states require that your certificate remain active for at least 3 years. The 3 years typically begins on the first day that the SR How long do I need the SR insurance filing/proof of insurance? It's important to know that if you cancel your car insurance policy before your required SR timeframe ends, your insurer must inform the traffic authorities. How long am I required to keep an SR22? Just because you have an SR on file now and are viewed as a high-risk driver currently doesn't mean that will be. While every state is different, the typical timeframe for maintaining an SR is around years. However, some may be as long as 5 years depending on the. How Long Does an SR Last on My Record? In California, you are required to keep your SR for at least three years. Canceling your insurance, lapsing when. If you already have car insurance but need to add an SR, simply call your insurance company and request they file the paperwork for you. Most states require. SR needs to be on file for three (3) years from the date the ticket was issued. Court Ordered Revocations – license revocation resulting from a court. Upon receipt, the driving record will be suspended. This suspension cannot be removed until the insurance filing has been reinstated. SR insurance must be. How long do I have to provide proof of financial responsibility? In most cases, 3 years from the date you're eligible to reinstate your license. See Learn how. Coverage Length:Most states require that your certificate remain active for at least 3 years. The 3 years typically begins on the first day that the SR The SR form is not an insurance policy. If you don't keep the SR current, the insurance Your driver license will be suspended for that reason alone. No Proof of Insurance – license suspension resulting from a court conviction for no proof of insurance. SR needs to be on file for three (3) years from the. How Long Does an SR Last on My Record? In California, you are required to keep your SR for at least three years. Canceling your insurance, lapsing when. If a driver is required to have an SR22 proof of insurance must be maintained for three years from the date they become eligible for reinstatement. If you fail. You will not need a Sr22 forever. While each state will vary most states will require a driver to have Sr22 for 3 years. When DMV receives the SR, the policy holder's driver's license is suspended until a new SR is filed. What happens if you're involved in an accident in.

Stocks In Small Cap Index

Small Cap. Portfolio Key: PJ. The Morningstar US Small Cap Index measures the performance of small-cap stocks in the U.S. It targets securities. There are essentially three indices available to invest with ETFs in USA small cap companies. This Investment Guide for USA small cap stocks will help you. Aggressive Small Caps ; SAVE. Spirit Airlines, Inc. ; MPLN. MultiPlan Corporation, ; DOLE. Dole plc, ; AVIR. Atea. S&P Small Cap Index ; Open. 1, Previous Close1, ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range1, - 1, BSE introduced the new index series called 'BSE MID-Cap' index and 'BSE Small-Cap' index to track the performance of companies with relatively smaller market. SMLL is the ticker symbol of the Small Cap Index index. Is Small Cap Index a Good Stock Market Index to Invest In? Small Cap Index offers exposure to a. Analyze the Fund Fidelity ® Small Cap Index Fund having Symbol FSSNX for type mutual-funds and perform research on other mutual funds. Bloomberg Ticker: SML. The S&P SmallCap ® seeks to measure the small-cap segment of the U.S. equity market. The index is designed to track companies that. U.S. small cap stocks, typically defined as those with a market capitalization of less than $2 billion, have historically offered higher returns than large. Small Cap. Portfolio Key: PJ. The Morningstar US Small Cap Index measures the performance of small-cap stocks in the U.S. It targets securities. There are essentially three indices available to invest with ETFs in USA small cap companies. This Investment Guide for USA small cap stocks will help you. Aggressive Small Caps ; SAVE. Spirit Airlines, Inc. ; MPLN. MultiPlan Corporation, ; DOLE. Dole plc, ; AVIR. Atea. S&P Small Cap Index ; Open. 1, Previous Close1, ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range1, - 1, BSE introduced the new index series called 'BSE MID-Cap' index and 'BSE Small-Cap' index to track the performance of companies with relatively smaller market. SMLL is the ticker symbol of the Small Cap Index index. Is Small Cap Index a Good Stock Market Index to Invest In? Small Cap Index offers exposure to a. Analyze the Fund Fidelity ® Small Cap Index Fund having Symbol FSSNX for type mutual-funds and perform research on other mutual funds. Bloomberg Ticker: SML. The S&P SmallCap ® seeks to measure the small-cap segment of the U.S. equity market. The index is designed to track companies that. U.S. small cap stocks, typically defined as those with a market capitalization of less than $2 billion, have historically offered higher returns than large.

#1 RAIL VIKAS NIGAM; #2 SUZLON ENERGY; #3 PERSISTENT SYSTEMS; #4 UNO MINDA; #5 LINDE INDIA. You can see the full list of the NIFTY SMALLCAP stocks here. Through the portfolio's investment in this fund, you get exposure to stocks issued by small U.S. companies. The fund is designed to track the performance of an. VIOO · Vanguard S&P Small-Cap ETF, Equity ; DGS · WisdomTree Emerging Markets SmallCap Dividend Fund, Equity ; IVOO · Vanguard S&P Mid-Cap ETF, Equity. Presentation · Objective The SMLL is designed to measure average stock performance tracking price movements within a universe of small capitalization stocks. SML | A complete S&P Small Cap Index index overview by MarketWatch. View stock market news, stock market data and trading information. For example, while the MSCI World Index comprises around 1, constituents, the MSCI World Small Cap Index boasts over 4, In emerging markets, the MSCI EM. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small cap. The blend style is assigned to portfolios where neither. The Russell Index, the first benchmark of small-cap stocks, is the best-known gauge. The market caps of its member companies currently range from about. stock holdings in a managers portfolio that differs from the benchmark index. Active share shown represents the fund compared to the Russell Growth index. Below you'll find the top scoring small cap stocks ranked by cheapness using a value composite. Small-cap value has been one of the best performing. The MSCI USA Small Cap Index is designed to measure the performance of the small cap segments of the US market. With 1, constituents, the index covers. The Russell is a small-cap stock market index composed of the 2, smallest companies in the Russell The index is frequently used as a benchmark for. The index, a member of the Dow Jones Total Stock Market Indices family, is designed to measure the performance of small-cap U.S. equity securities. The introduction of the Russell ® Index in the s marked a big step forward for small-cap companies and made it easier for investors to gain exposure. The investment seeks to track the performance of the Russell ® Index that measures the total return of small capitalization U.S. stocks. The fund. International Small-Cap Fund (I) ; Games Workshop Group PLC, ; Chiba Bank Ltd, ; CAR Group Ltd, ; AddTech AB, ; Riken Keiki Co Ltd, Top schemes of Small Cap Index Mutual Funds sorted by Returns ; Aditya Birla SL. Aditya Birla Sun Life Nifty Smallcap 50 Index Fund · Fund Size. ₹ Crs ; Axis. The Morningstar US Small Cap Index measures the performance of small-cap stocks in the U.S. It targets securities that fall between the 90% and 97% market. Most Active Small-Cap Stocks · MODG · Topgolf Callaway Brands to split into two companies · MODG · Topgolf Callaway to separate in two companies, shares surge.

Vcr Zacks

View Vanguard Consumer Discretionary ETF (VCR) stock price today Latest News. featured · Zacks Investment ResearchJul 22, Navigate Tax. VCR Quick Quote VCRPositive Net Change; ONLN Quick Quote ONLNPositive Net Change. Sweta Killa headshot. FAANG ETFs Face Off Amid New Tariffs: Apple Vs. Amazon. VCR - Vanguard Consumer Discretionary ETF - Stock screener for investors and traders, financial visualizations. VCR Action (FAST network); VCR Haha (FAST network). Laugh Out Loud (JV with ^ Equity, Zacks (April 13, ). "Lions Gate Reorganizes Operations. Explore award winning Zacks research plus our powerful analytic tools, including advanced charting, equity screening, backtesting, and much more. Act now to. The Zacks Analyst Blog Highlights iShares Core S&P ETF, iShares Month Treasury Bond ETF, SPDR Bloomberg Month T-Bill ETF, Vanguard S&P ETF and. Based on third party short interest data. PARTNER NEWS: Thu, May 23, AM, Zacks Should You Invest in. VCR, VDC. 5 ETF Areas to Play for Easter. 3/28/ - Zacks Investment Research Positive. These ETF investing areas should see an uptick in business this. Consumer Discretionary ETF (VCR) Hits New Week High (Zacks). Tesla ETFs Spike as Musk Announces Robotaxi Release (Yahoo Finance). View Vanguard Consumer Discretionary ETF (VCR) stock price today Latest News. featured · Zacks Investment ResearchJul 22, Navigate Tax. VCR Quick Quote VCRPositive Net Change; ONLN Quick Quote ONLNPositive Net Change. Sweta Killa headshot. FAANG ETFs Face Off Amid New Tariffs: Apple Vs. Amazon. VCR - Vanguard Consumer Discretionary ETF - Stock screener for investors and traders, financial visualizations. VCR Action (FAST network); VCR Haha (FAST network). Laugh Out Loud (JV with ^ Equity, Zacks (April 13, ). "Lions Gate Reorganizes Operations. Explore award winning Zacks research plus our powerful analytic tools, including advanced charting, equity screening, backtesting, and much more. Act now to. The Zacks Analyst Blog Highlights iShares Core S&P ETF, iShares Month Treasury Bond ETF, SPDR Bloomberg Month T-Bill ETF, Vanguard S&P ETF and. Based on third party short interest data. PARTNER NEWS: Thu, May 23, AM, Zacks Should You Invest in. VCR, VDC. 5 ETF Areas to Play for Easter. 3/28/ - Zacks Investment Research Positive. These ETF investing areas should see an uptick in business this. Consumer Discretionary ETF (VCR) Hits New Week High (Zacks). Tesla ETFs Spike as Musk Announces Robotaxi Release (Yahoo Finance).

im only half-kidding but that's zacks 'artistic style' he used extremely shallow depth of field for army of the dead too (first movie where. Latest VAW News ; 5 Top-Ranked Sector ETFs to Buy in June · Zacks Investment Research. 2 days ago ; Should You Invest in the Vanguard Materials ETF (VAW)? · Zacks. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since it has more than doubled. VCR: Vanguard Consumer Discretionary ETF options chain stock quote. Get the latest options chain stock quote information from Zacks Investment Research. Looking to buy VCR ETF? View today's VCR ETF price, trade commission Zacks Investment Research • 07/22/ Closing the Chapter on Inflation? ETFs. VCR - Vanguard Consumer Discretionary ETF - Stock screener for investors and traders, financial visualizations. A list of holdings for VCR (Vanguard Consumer Discretionary ETF) with details about each stock and its percentage weighting in the ETF. VCR Analysis · ByZacks Investment Research · Dec 29, Held by: VTI VB VXF VBK SCHA ULTY PAWZ VCR IBUY XRT, Scroll to (Zacks). AM · Chewy (CHWY) Reports Next Week: Wall Street Expects Earnings. Should You Invest in the Vanguard Consumer Discretionary ETF (VCR)?. by Zacks Equity Research Published on August 28, Sector ETF report for VCR. VCR. VCR Analysis · ByZacks Investment Research · Dec 29, has a Enterprise Value of. Enterprise Value charts, historical data, comparisons and more at Zacks Advisor Tools. In this video: FXD, VCR, XLY, FDIS · Facebook · Post · Share on stocktwits · LinkedIn. Watch · Buy Caterpillar Stock Ahead Of Q2 Earnings, Stay For The Dividend. {"current_url":"\/funds\/etf\/VCR\/all-news?page=22","prev_data_url":"\/funds\/etf\/VCR\/all-news?pagepage=21&type=json","response":". \n\n. \"\". {"current_url":"\/funds\/etf\/VCR\/all-news?page=70","prev_data_url":"\/funds\/etf\/VCR\/all-news?pagepage=69&type=json","response":". \n\n. \"\". Momentum Commerce. Zacks. Jul 17, See More. FAQ. Q. How do I buy Vanguard Consumer Discretion ETF (VCR) stock? A. You can purchase shares of Vanguard. VCR Action (FAST network); VCR Haha (FAST network). Laugh Out Loud (JV with ^ Equity, Zacks (April 13, ). "Lions Gate Reorganizes Operations. Amazon's Weak Sales Spoil Investors' Mood: ETFs in Focus - Zacks Investment Research Vanguard Consumer Discretionary Etf (VCR) 재무 분석. Vanguard. Learn everything about Vanguard Consumer Discretionary ETF (VCR). News, analyses, holdings, benchmarks, and quotes. zacks-logo. 1 (Strong Buy). CFRA Logo. street-logo. C- (Hold). How We Rank The Vanguard's extensive fixed income lineup caters to beginner and advanced.

1 2 3 4 5